My big homie Donnie lived that paycheck-to-paycheck life in Boston for years.

The type of life that makes you feel stressed about making ends meet and you always feel weighed down by debt.

He was that one friend who had a band-aid for every cut Lol.

Lemme share some highlights of his best work from our past text message:

Him wiggling out of us catching up for dinner at a sports bar

Me: "Yo Don... let’s grab a bite to eat after work, I know this dope sports bar selling fusion tacos and strong mixed drinks."

Donnie: "Ahhh maaaaan, I'm trying to hold on to some cash this month, you know? I have this big project coming up, and every dollar counts. Let's just chill at your house and split a pizza or something, yeah?"

2. Him trying to avoid paying for coat check, cover, and drinks at the club

Me: This new club just opened up downtown, I heard the DJs spin a lot of Dancehall and Rap music and we know that’s your favorite...let's pull up and check out the scene tonight."

Donnie: "Bro, I'm beat from work today, seriously. Plus, I've been trying to cut back on the nightlife a bit, you know, for my health and wallet. Let's catch up over the Celtics vs Clippers game instead."

3. Him devising a crafty plan to not spend money on his girl for Valentine’s Day.

Me: Please tell me you're getting Monica something for Valentine’s this year.

Donnie: "Honestly, I've been thinking...instead of a gift and all that, I'm gonna suggest we do something different this year like have a cozy night in, cook our favorite meal together, or maybe binge-watch some of her favorite shows. It'll be our own little Valentine's retreat, you know?"

I became immune to him telling me that every month was a constant struggle, and he didn't know if he would ever escape the vicious cycle.

Then...

One day, outta desperation, he went to YouTube University and started searching for content based around "Ways to save more money each month" or "Easy ways to pay off debt fast"

This decision drastically shifted the direction of his life. He whipped out a good ole fashion pen and paper and prioritized his finances once and for all.

He told me the advice from the videos gave him the confidence to:

write out his weekly budget

scrutinize every purchase he makes

cut out any purchase that wasn't necessary

It wasn't easy at first but he realized sacrifices had to be made to swing the pendulum.

He stuck to his budget religiously, and slowly but surely he started to see the results.

Within a few months...he had paid off his credit card debt.

Within a year...he built up a comfy emergency fund and started saving for the future.

Today, Donnie is debt-free and way more financially secure than he was, and he and Monica actually flew out to Tulum and stayed in a villa for the Valentines that just passed.

His story is a powerful reminder that no matter how bad your financial situation is, it's never too late to turn things around.

With a little discipline and determination, anyone can achieve financial stability and build a brighter future for themselves.

Your Bad Spending Habits Will Keep You Poor

Tell me something...

Are you tired of constantly feeling the squeeze of financial strain?

Are You ready to grab control of your money and start building a secure future?

You're not alone...

Many guys find themselves struggling to manage their finances effectively, but the good news is that it's never too late to turn things around as you saw with my friend, Donnie.

By putting some powerful strategies in place, you can start making smarter financial decisions that will put your Nike joggers on the path to financial freedom.

I read the book "The Total Money Makeover" by Dave Ramsey, and he had a powerful quote that said:

Personal finance is 80% behavior and only 20% head knowledge.

In my opinion, he emphasizes the importance of behavior in personal finance. Ramsey argues that while understanding financial concepts is essential, it's our actions and habits that ultimately determine our financial success.

We can easily say that Donnie is living proof of this when he decided to pull out the pen and paper in the first place.

Dave Ramsey stresses the significance of discipline, budgeting, and living within one's means.

So the reason his quote stands out to me is because it sums up Ramsey's central message that real change in financial situations comes from changing behaviors and attitudes towards money, instead of acquiring knowledge about finances.

To make sure this concept sinks into your skull cap, I'll hit you with another

powerful quote.

This time it comes from Robert T. Kiyosaki, author of "Rich Dad Poor Dad," who said,

The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth in what seems to be an instant.

This quote stuck out to me because Kiyosaki describes that mindset and financial education have to go hand-in-hand if you want to build wealth.

In the book, he went on to argue that a person's mindset towards money and financial education are way more crucial determinants of success than traditional measures like income or formal education.

So a man with a plan of action can become more financially empowered than a man with 3 master’s degrees.

This quote underscores Kiyosaki's belief that anyone can create wealth and financial freedom, regardless of their starting point.

Automatically my mind goes back to how Donnie was able to dig himself out of debt and live a now stress-free life.

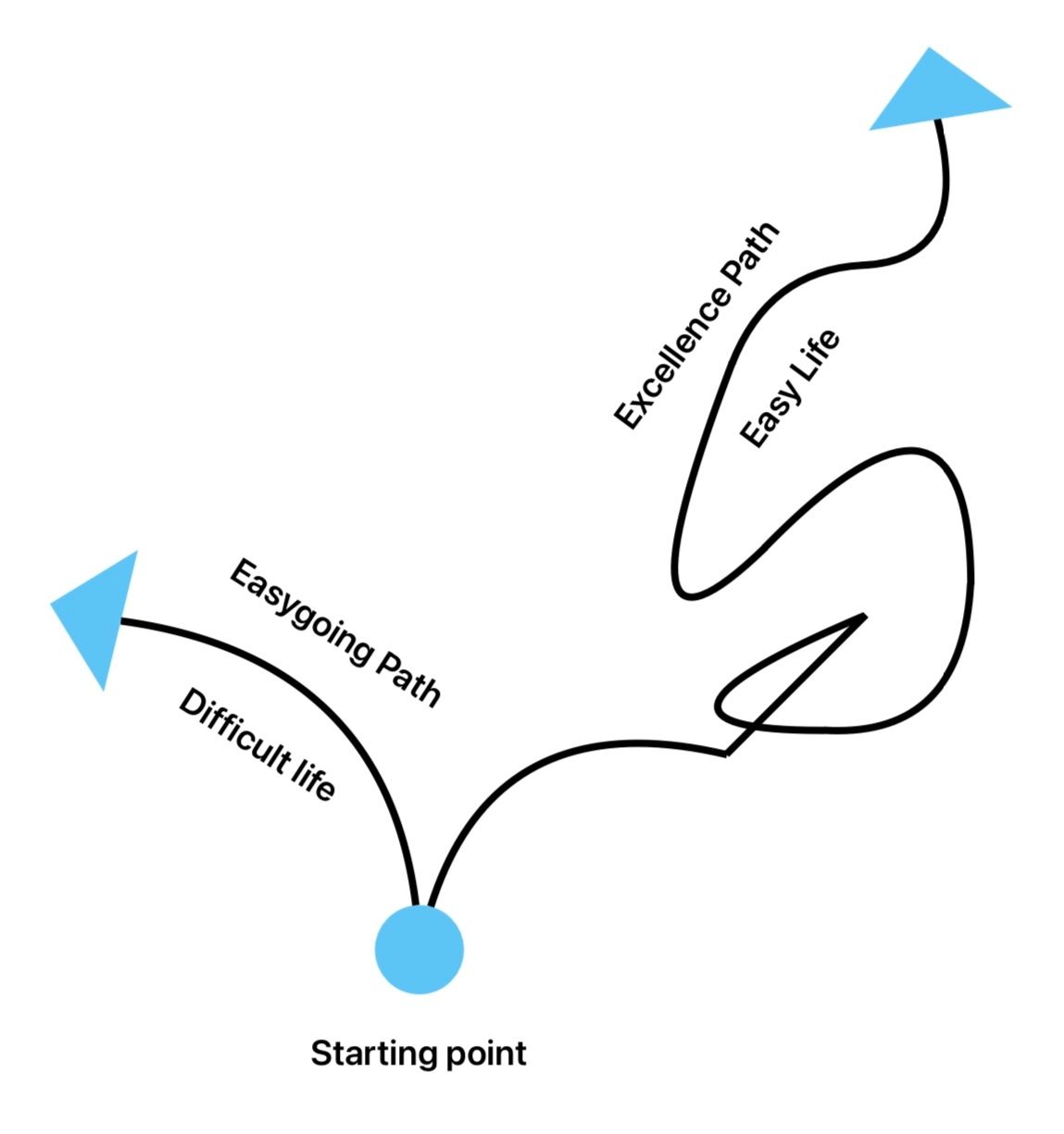

The Two Paths - Only One Leads to Financial Freedom

Imagine your financial situation as a journey to the top of Mount Everest.

You're trekking along, trying to navigate your way to the peak of financial security.

You encounter two types of guides offering you advice - The "easygoing" guide and the

"excellence" guide.

The "easygoing" guide is like a map that leads you on a path of least resistance that is:

familiar

comfortable

not much effort is needed.

However, this guide often takes you through sketchy shortcuts and dead ends and often leaves you stranded.

You may feel like you're making progress, but in reality, you're only treading water, and nowhere close to reaching your destination.

On the other hand, the "excellence" guide is like a seasoned mountaineer, who knows every peak and valley of the financial landscape who:

strive for greatness

urges you to climb higher

forces you out of your comfort zone

Yes, the journey is way more challenging, but with each step, you gain valuable skills and insights to propel you closer to your goals.

So instead of settling for mediocrity (a poor life), you aim for excellence in every aspect of your financial life.

In the same way, a skilled mountaineer never stops climbing halfway up the mountain, you shouldn't settle for halfway managing your money.

By following the advice of the excellence guide, you'll not only reach the peak of financial success but also have the knowledge and confidence to conquer any financial challenges that come your way.

So, which guide will you choose to follow on your journey to financial freedom?

7 Things To Get You On The Right Path

1| Don’t Buy to Impress Others, Focus On Needs Over Wants

Let's keep it a buck

When you try to keep up with everyone else, it feels like you're running on a hamster wheel...you'll never get ahead.

By focusing on what you need instead of what you think others expect, you'll save cash and live a more authentic and less expensive life.

Buying to impress other people = making unnecessary purchases.

Focus on your needs over your wants and prioritize spending and saving money.

2| Cancel Unused Subscriptions

Do you know those subscriptions that quietly sneak out of your account every month?

The gym membership that you use one week per month

Streaming subscriptions like Netflix, Hulu or Disney+

Gaming subscriptions like Xbox Live Gold or PlayStation Plus

Software subscriptions to cloud storage or antivirus programs

The worst is when you check your bank statement at the end of the month and it leaves you scratching your head in confusion.

Well, this would indicate that it's time to start playing detective and cancel the ones that aren't pulling their weight.

By doing this, it will free up cash for things you actually enjoy and help you save money.

3| Create Grocery Shopping Lists to Avoid Unnecessary Spending

How many times have you walked into the store with a list, and you're determined to stick to it?

But then...

The snacks on the shelf start to entice you, and before you know it, your cart's overflowing.

I can tell you straight up that impulse buying at the grocery store leads to overspending.

So write out a list or use a productivity app on your phone to help you stay on track and avoid those sneaky extra purchases.

4| Avoid Buying Out of Boredom or Habit

I know I'm not the only one who fell victim to this.

You're bored, scrolling through your phone, and suddenly, you're hitting "buy now" on stuff you never knew you wanted.

Sound familiar?

Your best bet is to find other ways to beat boredom.

By doing this, you'll save cash and avoid cluttering your life with impulse buys.

5| Reduce Eating Out and Grabbing Takeout gradually

Bruh!

Trust me...that daily dose of takeout adds up faster than you can say "delivery," but going cold turkey is like trying to quit caffeine.

It's rough.

So, easing into cooking at home more often lets you adjust without feeling deprived of your favorite eats.

There is a channel on YouTube called “Mind Over Munch” that gives me the confidence to make the junk food that I love but with WAAYY fewer calories, so I don't feel as guilty as if I were eating the real thing.

Eating out frequently can add up in expenses over time so gradually cutting back saves money.

6| Use Cash or Debit Cards Instead of Credit Cards

Swipe, swipe, swipe - that's the sound of overspending on credit cards

But with cash or debit, you're forced to face the reality of your bank balance, making it easier to stick to your budget and avoid that post-shopping guilt trip.

Credit cards can lead to overspending and debt if you’re not responsible, so using cash or debit cards helps stay within budget and avoid interest charges.

7| From Fast Fashion to Timeless Clothes

You can deny that fast fashion has that "Buy Now, Regret It Later" vibe, but trust me, those impulse buys pile up like dirty laundry.

If you focus on investing in quality timeless pieces, this would result in fewer shopping sprees and more wear from your wardrobe.

You would save so much cash in the long run.

Fast fashion items end up unused, so opt for more versatile and timeless pieces.

Alright my Gz, until the next newsletter.

Thanks for reading and for being a supporter.

Please subscribe by entering your email address below!

Much Love.

Javito